Double entry bookkeeping is a systematic method of recording financial transactions, ensuring each transaction affects at least two accounts, maintaining balance and accuracy in financial records.

Definition and Overview

Double entry bookkeeping is a fundamental accounting method where every financial transaction is recorded twice, once as a debit and once as a credit, ensuring the books remain balanced. This system captures the dual aspects of transactions, such as the source and use of funds, providing a comprehensive view of a business’s financial health. Unlike single entry bookkeeping, which only tracks cash inflows and outflows, double entry bookkeeping offers detailed insights into income, expenses, assets, and liabilities. It is essential for businesses, especially those handling credit transactions, as it ensures accuracy and completeness in financial reporting.

Importance in Financial Accounting

Double entry bookkeeping is the foundation of modern financial accounting, ensuring accuracy and transparency in recording transactions. It provides a clear picture of a company’s financial position by balancing assets, liabilities, and equity. This method is essential for compliance with accounting standards and regulatory requirements. By maintaining detailed records of debits and credits, businesses can prepare accurate financial statements, such as balance sheets and income statements. It also facilitates audits and financial analysis, enabling stakeholders to make informed decisions. The dual recording system helps detect errors and fraud, making it indispensable for maintaining trust and integrity in financial reporting.

Core Principles of Double Entry Bookkeeping

Double entry bookkeeping relies on recording transactions with equal debits and credits, ensuring balance and accuracy in financial records through dual aspects of each transaction.

The Dual Aspects of Transactions

In double entry bookkeeping, every transaction has two equal and opposite effects, recorded as debits and credits. This duality ensures the accounting equation remains balanced. For example, paying a utility bill reduces cash (credit) and increases expenses (debit). Each transaction impacts two accounts, providing a comprehensive view of financial activities. This principle prevents errors and ensures accuracy, as every entry must balance. It also allows businesses to track both the source and use of funds, offering insights into financial health beyond just cash flow. This dual recording is essential for maintaining reliable and complete financial records.

Debit and Credit Entries

In double entry bookkeeping, every transaction records a debit and a credit of equal amounts. Debits increase assets or expenses and decrease liabilities or equity, while credits do the opposite. For example, paying a utility bill debits the expense account and credits the cash account. This ensures the accounting equation (Assets = Liabilities + Equity) remains balanced. Debits are recorded on the left side, and credits on the right, providing a clear audit trail. Proper use of debits and credits is crucial for accurate financial reporting and maintaining balanced books, ensuring transparency in business operations and decision-making.

Account Types and Categories

In double entry bookkeeping, transactions are categorized into specific account types to ensure organized and accurate recording. The primary account types include assets, liabilities, equity, revenue, and expenses. Assets represent resources owned by the business, while liabilities and equity reflect its financial obligations and ownership claims. Revenue accounts track income earned, and expense accounts record costs incurred. Each transaction affects at least two accounts, maintaining the balance of the accounting equation. Proper categorization ensures clarity in financial reporting, enabling businesses to track performance, manage resources, and comply with accounting standards effectively.

Key Components of Double Entry Bookkeeping

Double entry bookkeeping relies on ledger accounts, general ledger structure, and debit-credit rules, ensuring each transaction impacts two accounts, maintaining financial balance and accuracy.

Ledger Accounts and Their Role

Ledger accounts are the core of double entry bookkeeping, serving as the central location for recording and summarizing all financial transactions. Each account represents a specific aspect of the business, such as cash, expenses, or liabilities. When a transaction occurs, it is recorded in at least two accounts: one debited and one credited. Ledger accounts ensure that every transaction is balanced, maintaining the integrity of the financial records. They provide a detailed view of how resources are used and obligations are managed, enabling accurate financial reporting and analysis. Examples include cash ledgers for tracking payments and expense ledgers for monitoring business costs.

General Ledger and Its Structure

The general ledger is a comprehensive record of all financial transactions, organized into individual accounts. It serves as the central repository for summarizing and balancing entries from various journals. Each account within the ledger is categorized, such as assets, liabilities, equity, revenue, and expenses. Transactions are recorded with equal debits and credits, ensuring the accounting equation remains balanced. The ledger’s structure allows for easy preparation of financial statements, providing a clear overview of a company’s financial position and performance. Regularly updated, it ensures compliance with accounting standards and facilitates audits, making it an essential tool for accurate financial reporting and analysis.

Debit and Credit Rules

In double entry bookkeeping, debit and credit rules govern how transactions are recorded. Debits increase assets and expenses, while credits increase liabilities, equity, and revenue. Each transaction requires equal debits and credits, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. Debits are recorded on the left side of an account, and credits on the right. These rules maintain consistency and accuracy in financial records, enabling the preparation of reliable financial statements. Adhering to these principles is essential for compliance with accounting standards and effective financial management.

The Double Entry Bookkeeping Process

Double entry bookkeeping involves systematically recording transactions with equal debits and credits, ensuring financial integrity and balance across all accounts.

Step-by-Step Transaction Recording

Recording transactions in double entry bookkeeping involves identifying the two accounts affected, determining the nature of the transaction, and applying debit and credit rules. For example, paying a utility bill reduces cash (credit) and increases expenses (debit). Similarly, receiving a loan increases cash (debit) and liability (credit). Each transaction must balance, ensuring debits equal credits. This systematic approach ensures accuracy and completeness in financial records, providing a clear picture of a business’s financial position and performance. Examples include cash transactions, credit purchases, and asset acquisitions, each requiring careful documentation to maintain accounting integrity.

Preparing Journal Entries

Preparing journal entries involves documenting transactions with equal debits and credits. For example, a $10,000 utility payment debits expenses and credits cash. A $30,000 loan receipt debits cash and credits liabilities. Each entry includes dates, account names, and amounts, ensuring the accounting equation remains balanced. Journal entries provide a chronological record of transactions, serving as the foundation for ledger posting. They enable businesses to track financial activities accurately, facilitating the preparation of financial statements. Properly structured journal entries are essential for maintaining transparency and accountability in financial reporting, ensuring compliance with accounting standards and facilitating audits. Examples in PDF guides illustrate this process clearly.

Posting to Ledger Accounts

Posting to ledger accounts involves transferring journal entry details to individual accounts. Each debit and credit from journal entries is recorded in respective ledger accounts. For example, a $10,000 utility payment debits the expense account and credits the cash account. Similarly, a $30,000 loan deposit debits cash and credits the liability account. Ledger accounts summarize transactions, showing account balances. This process ensures all financial data is organized and easily accessible. Ledger posting is crucial for preparing financial statements, as it provides a clear view of each account’s activity and balance. PDF guides offer practical examples to illustrate this process effectively.

Common Examples of Double Entry Bookkeeping

Examples include cash transactions, credit purchases, asset acquisitions, and expense recordings. Each transaction involves debits and credits across different accounts, ensuring balanced financial records;

Cash Transactions and Their Recording

Cash transactions involve recording money received or paid. For example, paying a utility bill of $10,000: debit expense, credit cash. Depositing a $30,000 loan: debit cash, credit liability. Each transaction affects two accounts, ensuring balanced books. This method provides clarity on financial position, distinguishing cash flow from overall net assets. Proper recording aids in accurate financial reporting and compliance with accounting standards. These examples highlight how double entry bookkeeping captures both sides of cash movements, essential for transparent and reliable financial records.

Credit Purchases and Sales

Credit purchases and sales involve recording transactions where payment is deferred. For example, buying goods on credit: debit purchases, credit accounts payable. Selling goods on credit: debit accounts receivable, credit sales. This dual entry captures both the asset/liability and income/expense aspects. It ensures accurate tracking of receivables and payables, essential for cash flow management. Proper recording aids in maintaining balanced books and provides a clear view of business performance. These transactions highlight the importance of double entry bookkeeping in managing credit-based dealings efficiently and ensuring financial records are comprehensive and reliable.

Asset and Liability Transactions

Asset and liability transactions are recorded using double entry bookkeeping to maintain the accounting equation: Assets = Liabilities + Equity. For example, when a business takes a loan, cash (asset) increases, and loans payable (liability) also increases. Both accounts are updated with equal debits and credits. Similarly, purchasing equipment with cash affects two assets: equipment and cash. This method ensures every transaction’s dual impact is captured, providing a clear view of a company’s financial position. Proper recording of these transactions is essential for accurate balance sheets and financial reporting, ensuring accountability and transparency in business operations.

Revenue and Expense Transactions

Revenue and expense transactions are recorded using double entry bookkeeping to reflect their impact on a company’s profitability. For example, when a business earns $1,000 in sales, it debits cash (or accounts receivable) and credits revenue. Conversely, when it incurs a $500 utility expense, it debits the utility expense account and credits cash. This dual recording ensures that both the income and expenditure sides of the transaction are captured. Properly recording these transactions helps in preparing accurate income statements, providing insights into a company’s financial performance and profitability over a specific period.

Practical Illustrations and Scenarios

Downloadable PDF guides provide step-by-step examples of double entry bookkeeping, including transactions like cash purchases, credit sales, loans, and depreciation, with exercises for practical application.

Recording Loans and Borrowings

Recording loans and borrowings involves documenting both the receipt and repayment of funds. When a business takes a loan, it debits the cash account and credits the loan payable account. Repayments are recorded by debiting the loan payable account and crediting the cash account. Interest on loans is debited to interest expense and credited to the loan account. PDF guides provide detailed examples, such as recording a $10,000 loan as a debit to cash and credit to loan payable, ensuring accurate tracking of liabilities and interest expenses. These examples help in understanding the dual impact of loan transactions on financial statements.

Handling Depreciation and Amortization

Depreciation and amortization are non-cash expenses recorded using double entry bookkeeping. Depreciation allocates the cost of tangible assets over their useful lives, while amortization applies to intangible assets. For example, a company purchases machinery for $50,000 with a 5-year life. Each year, debit depreciation expense $10,000 and credit accumulated depreciation $10,000. Similarly, for a patent costing $20,000 over 10 years, debit amortization expense $2,000 annually and credit the patent account $2,000. PDF guides provide exercises to practice these entries, ensuring accurate representation of asset values and expenses on financial statements.

Adjusting Entries and Their Impact

Adjusting entries are made to update account balances and ensure accuracy in financial statements. They record transactions that were not captured during the accounting period, such as accrued revenues or expenses. For example, if a company earned $5,000 in December but the payment was received in January, an adjusting entry debits accounts receivable and credits revenue; Similarly, for unpaid salaries, debit salary expense and credit salaries payable. These entries ensure revenues and expenses are recognized in the correct period. PDF guides provide exercises to practice adjusting entries, highlighting their role in maintaining accurate financial records and compliance with accounting standards.

Benefits of Double Entry Bookkeeping

Double entry bookkeeping enhances accuracy, ensures compliance with accounting standards, and provides a clear financial overview, facilitating audits and informed business decision-making through detailed transaction records.

Accuracy and Completeness in Financial Records

Double entry bookkeeping ensures accuracy by recording each transaction in two accounts, maintaining balance and reducing errors. It provides a complete financial picture, tracking both sides of every transaction. This method minimizes discrepancies, prevents fraud, and ensures compliance with accounting standards. By maintaining detailed and balanced records, businesses can generate precise financial statements, enabling better decision-making. The dual recording process also helps in identifying and correcting errors promptly, ensuring the integrity of financial data. This level of detail and accountability makes double entry bookkeeping indispensable for maintaining reliable and comprehensive financial records.

Compliance with Accounting Standards

Double entry bookkeeping ensures compliance with accounting standards like GAAP and IFRS by maintaining balanced and accurate financial records. Each transaction is recorded in two accounts, ensuring the accounting equation remains intact. This method adheres to the principles of consistency, comparability, and transparency, which are essential for financial reporting. By following double entry rules, businesses align their accounting practices with regulatory requirements, reducing the risk of non-compliance penalties. This systematic approach also facilitates audits and ensures financial statements are reliable and trustworthy, meeting the expectations of stakeholders and regulatory bodies.

Facilitating Audits and Financial Analysis

Double entry bookkeeping simplifies audits and financial analysis by providing a clear audit trail and detailed financial data. Each transaction is recorded in two accounts, creating a transparent and balanced record of all financial activities. This structure allows auditors to trace transactions easily, ensuring compliance and accuracy. Additionally, the detailed accounts enable comprehensive financial analysis, such as expense tracking, revenue monitoring, and liability management. The availability of double entry bookkeeping examples in PDF formats further aids in understanding and applying these principles effectively, making it a cornerstone of modern accounting practices for businesses of all sizes.

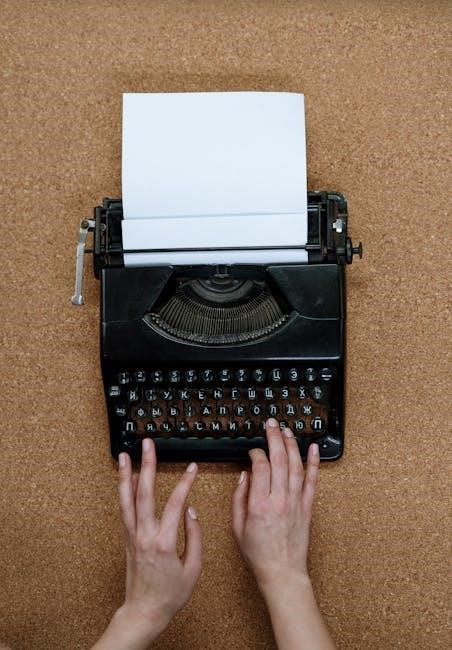

Resources for Learning Double Entry Bookkeeping

Downloadable PDF guides and templates provide practical examples and exercises, helping learners master double entry bookkeeping through real-world scenarios and step-by-step instructions.

Recommended PDF Guides and Templates

Downloadable PDF guides and templates offer comprehensive examples and exercises for mastering double entry bookkeeping. These resources provide step-by-step instructions, practical scenarios, and real-world applications to enhance understanding. They include completed manual examples, mini-guides for single and double entry systems, and printable forms for various transactions. Users can access these materials to practice recording transactions, preparing journal entries, and posting to ledger accounts. The templates are ideal for businesses and accounting professionals, ensuring accurate and organized financial record-keeping. These PDF resources are essential tools for learners seeking hands-on experience with double entry bookkeeping principles and practices.

Practice Questions and Exercises

Practice questions and exercises are essential for mastering double entry bookkeeping. They provide hands-on experience in recording transactions, identifying debits and credits, and preparing journal entries. These exercises cover various scenarios, such as cash transactions, credit purchases, and asset acquisitions. By working through these problems, learners can apply theoretical concepts to real-world situations, improving their understanding of account types and financial reporting. Many resources offer downloadable PDFs with practice questions, answers, and detailed solutions, allowing users to test their skills and track progress in double entry bookkeeping effectively.